How to Send Parcels from the UK to the EU in 2025 — Customs, Costs, and the Best Courier Options Explained

If you’re looking to ship goods from the UK to the European Union, the rules have changed significantly since Brexit. Whether you’re sending a gift, forwarding your UK purchases abroad, or managing business shipments, you’ll want to understand the updated process, what’s required, and how to choose the best courier option. This guide will walk you through sending parcels to the EU post-Brexit, explain the customs and paperwork involved, highlight how shipping from the UK to EU after Brexit works, and provide the courier options that matter in 2025.

How Shipping from UK to EU after Brexit Has Changed

Since 1 January 2021, the UK is treated as a non-EU country for customs and VAT purposes. This means that whether you are a private individual or a business, shipping goods from the UK to the EU now requires export and import declarations, and in many cases new paperwork and customs formalities.

For example:

- When sending to the EU you must complete a customs declaration form even for relatively low-value parcels.

- Certain goods may be subject to VAT or duty at the destination country.

- Couriers and forwarders now often require commodity (HS) codes and accurate descriptions of goods to avoid delays.

In short, shipping from the UK to EU after Brexit is still entirely possible and practical but you must be aware of the extra steps and select your shipping method and forwarding service accordingly.

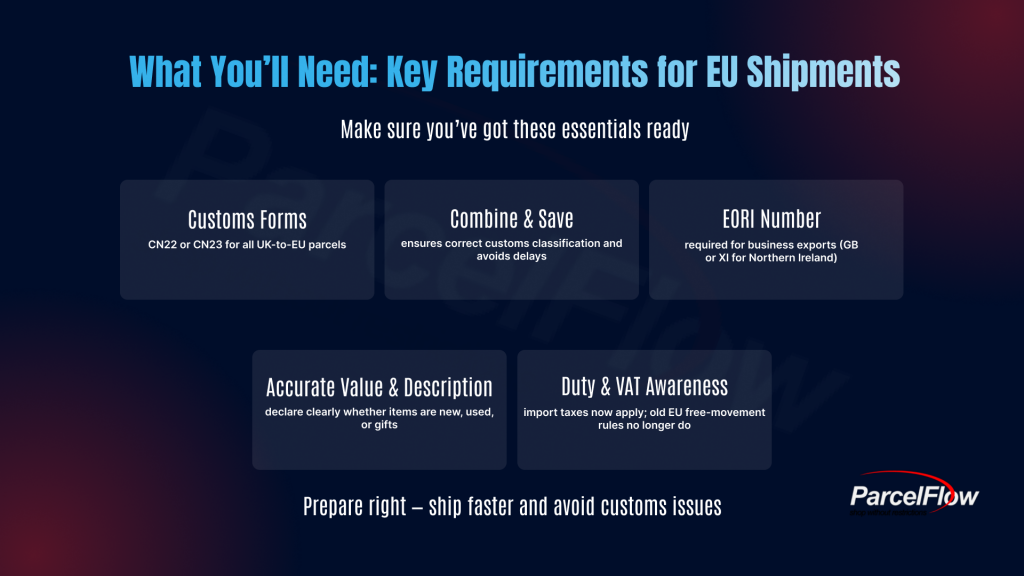

What You’ll Need: Key Requirements for EU Shipments

When you prepare to send parcels to the EU post-Brexit, here are the essential components:

Customs documentation. Any parcel (not just large freight) shipped from the UK to the EU needs a customs declaration form. For postal services, forms like CN22 or CN23 may apply.

Correct HS code/commodity code. This classification helps customs identify the goods and apply the correct rules or duties. Incorrect or missing codes often result in delays.

EORI number (if you’re exporting as a business). If your shipments are commercial, you’ll likely need a GB EORI number, and if you’re dealing with Northern Ireland flows you may also need an XI code.

Accurate value and description. You must declare the value of the goods and a clear description — whether new, used, or a gift. Couriers often refuse parcels without this.

Understanding duty & VAT. Many EU states now require you to pay import VAT or duty depending on the value and origin of the goods. The free movement rules no longer apply as they did pre-Brexit.

Choosing the Right Courier or Forwarding Service

How you send your parcel impacts cost, speed, and reliability. Here are options and what to look out for:

Postal services – For smaller parcels this can work, but you’ll still need full customs details and there may be longer transit times.

Large couriers – Providers like DHL, UPS, or FedEx offer dedicated export/import services and handle many of the customs steps for you. For example, DHL’s guide emphasises the need to complete declarations regardless of whether items are personal or commercial.

UK parcel forwarding service – If you’re shopping in the UK and forwarding to the EU, a forwarding company can act as your UK address and manage consolidation, forwarding and customs. This is especially helpful for private shoppers or small businesses.

Key criteria when selecting a courier or forwarding partner:

- Clear guidance on EU-bound shipments after Brexit.

- Support for customs compliance (forms, HS codes, EORI if needed).

- Transparent tracking and delivery times.

A presence or expertise in UK to EU flows some services specialise in this area.

Common Mistakes and How to Avoid Them

Several pitfalls commonly affect UK-to-EU shipments. Being aware helps you avoid extra fees, delays or returned parcels.

Using old rules. Treating the UK-EU route like pre-Brexit can lead to missing documentation and customs hold-ups.

Incorrect commodity codes. Without accurate HS codes you may attract additional checks or charges.

Undervaluing or mis-describing goods. All shipments need full and honest descriptions.

Assuming no duties apply. Not all goods qualify for duty-free status; origin, value and item type matter.

Ignoring shipping partner’s EU readiness. Choose a provider experienced in “send parcels to EU post-Brexit” flows.

Tips for Smooth UK → EU Parcel Forwarding

- Prepare documentation in advance and check if your provider supplies customs forms or templates.

- Combine shipments where possible (consolidation) to save on international shipping and customs overheads.

- Choose forwarders or couriers with UK parcel forwarding and forwarding from UK to EU experience.

- Check if your goods qualify for any preferential origin terms (under the EU-UK Trade & Cooperation Agreement) which may reduce duty.

- Maintain accurate records for each shipment description, value, origin, HS code, consignee details.

- Consider virtual UK address or UK depot storage if you’re gathering items in the UK before sending them to the EU.

Why 2025 Is a Good Time to Send Parcels from UK to EU

Although the rules have become more complex, the infrastructure has matured. Many logistics providers now handle EU-bound shipments with pre-built customs workflows and dedicated lanes. The “shipping from UK to EU after Brexit” gap has narrowed significantly meaning you can still enjoy UK retail benefits along with dependable delivery to Europe.

Whether you’re buying UK brand items, running an online store, or forwarding parcels as an expat, the UK→EU route remains viable. With the right planning and partner, you’ll avoid major headaches and keep your delivery chain smooth.

Final Call to Action

If you plan to forward parcels from the UK to the EU in 2025, make sure you’re working with a partner who understands send parcels to EU post-Brexit workflows and offers UK parcel forwarding to EU countries. At Parcel Flow, we provide everything you need for a UK address for shopping, parcel consolidation, EU-ready forwarding and customs support.

Ready to start? Contact us today or create your free UK address to begin shipping seamlessly from the UK to Europe.